Revenue Analyses:

Income Tax Analyses:

Numbers — Charts:

| Tweet | | Contact | Follow @chrischantrill |

What is the Total US Government Revenue?

In FY 2024, total US government revenue, federal, state, and local, is “guesstimated” to be $10.57 trillion. Federal revenue is budgeted at $5.08 trillion; state revenue is “guesstimated” at $3.55 trillion; local revenue is “guesstimated” at $1.94 trillion.

a usgovernmentrevenue.com briefing:

Estimated Government Revenue for FY 2024

In 2024 the governments in the United States are expected to collect about

38.9

percent of Gross Domestic Product in revenue. The federal government will collect about

18.7

percent of GDP, the states will collect about

12.8

percent of GDP, and local governments about

7.0

percent of GDP.

Government Revenue: Federal, State, Local

Governments in the US will collect $10.57 trillion in 2024.

In fiscal 2024 the federal government budgets that revenue will be $5.1 trillion. State revenue for 2024 is "guesstimated" by usgovernmentrevenue.com at $3.5 trillion and local government revenue is "guesstimated" by usgovernmentrevenue.com at $1.9 trillion.

Total revenue at all levels of government in the United States is "guesstimated" by usgovernmentrevenue.com to be $10.6 trillion in 2024.

Government Revenue: the Sources

The governments in the US collect about $7.2 trillion a year in income and payroll taxes.

Income tax is where governments collect the most tax: in federal, state, and local income tax they will collect about $3.9 trillion in 2024. Next in line are social insurance taxes, including Social Security, unemployment and hospital taxes, adding up to $3.3 trillion. Ad-valorem taxes, i.e. sales taxes and property taxes, will amount to about $2.2 trillion in 2024. Fees and Charges will add up to $0.6 trillion, and Business and Other Revenue will add up to $0.5 trillion in 2024.

These revenue estimates are based on projections in the federal budget for federal revenue and on "guesstimates" of state and local revenue by usgovernmentrevenue.com.

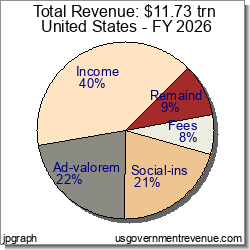

Pie Chart of Total Government Revenue

Chart 3.04: Total Revenue Pie

Total government revenue in the United States, including federal, state, and local governments, is expected to total $10.57 trillion in 2024. The total features five major sources. The largest share is social insurance at 37 percent of total revenue; income taxes, at 35 percent of total revenue; ad-valorem taxes, at 16 percent of revenue; all other revenue at 12 percent of total revenue.

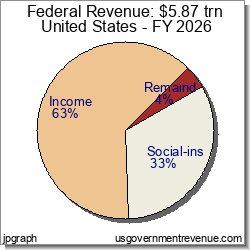

Pie Chart of Federal Government Revenue

Chart 3.05: Federal Revenue Pie

Federal revenue is budgeted at $5.08 trillion for FY 2024. Almost all revenue comes from income taxes, individual and corporate, at 58 percent of total federal revenue; and social insurance taxes, such as the FICA tax, at 36 percent of total federal revenue.

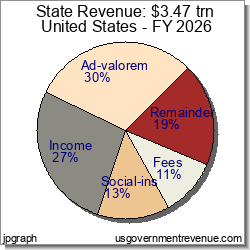

Pie Chart of State Government Revenue

Chart 3.06: State Revenue Pie

State government revenue, as "guesstimated" by usgovernmentrevenue.com, will total about $3.55 trillion in FY 2024, and is balanced between five major sources. The largest revenue source is social insurance taxes, including income from state employee retirement systems, amount to 52 percent of state revenue. Ad-valorem taxes — property and sales taxes — amount to 17 percent of total state revenue. State income taxes are 13 percent of total state revenue. Fees and charges amount to 10 percent of total state revenue; state business revenue comes in at 8 percent of receipts.

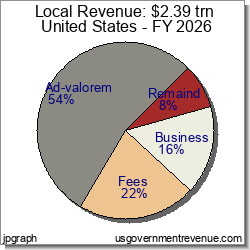

Pie Chart of Local Government Revenue

Chart 3.07: Local Revenue Pie

Local government revenue, as "guesstimated" by usgovernmentrevenue.com, will total about $1.94 trillion in FY 2024, and is dominated by ad-valorem taxes — i.e. property and sales taxes — amounting to 46 percent of total local government revenue. Fees and changes amount to 22 percent of local revenue; business revenue, such as utilities and liquor stores, amounts to 19 percent of total local revenue. Social insurance taxes, including income from local employee retirement systems, amount to 14 percent of local revenue.

Suggested Video: All About Income Tax

Top Revenue Requests:

Find DEFICIT stats and history.

US BUDGET overview and pie chart.

Find NATIONAL DEBT today.

DOWNLOAD revenue data.

See FEDERAL BUDGET breakdown and estimated vs. actual.

Check INCOME TAX details and history.

See BAR CHARTS of revenue.

Check STATE revenue: CA NY TX FL and compare.

See REVENUE ANALYSIS briefing.

See REVENUE HISTORY briefing.

Take a COURSE at Taxes 101.

Make your own CUSTOM CHART.

Revenue Data Sources

Revenue data is from official government sources.

- Federal revenue data since 1962 comes from the president’s budget.

- All other revenue data comes from the US Census Bureau.

Gross Domestic Product data comes from US Bureau of Economic Analysis and measuringworth.com.

Detailed table of revenue data sources here.

Federal revenue data begins in 1792.

State and local revenue data begins in 1820.

State and local revenue data for individual states begins in 1957.

Site Search

Spending 101

Take a course in government spending:

Spending |

Federal Debt |

Revenue

Defense |

Welfare |

Healthcare |

Education

Debt History |

Entitlements |

Deficits

State Spending |

State Taxes |

State Debt

It’s free!

Win Cash for Bugs

File a valid bug report and get a $5 Amazon Gift Certificate.

Get the Books

Price: $0.99 Or download for free. |

From usgovernment spending.com Price: $1.99 |

Life after liberalism Price: $0.99 Or download for free. |

Data Sources for 2024:

GDP, GO: GDP, GO Sources

Federal: Fed. Budget: Hist. Tables 2.1, 2.4, 2.5, 7.1

State and Local: State and Local Gov. Finances

'Guesstimated' by projecting the latest change in reported revenue forward to future years

> data sources for other years

> data update schedule.

Blog

Federal Budget for FY25 Released

On March 11, 2024, we updated usgovernmentspending.com with the numbers from the Public Budget Database in the Budget of the United States Government for Fiscal Year 2025.

Here is how headline budget estimates for the upcoming FY 2024 fiscal year have changed since the release of the FY 2024 budget a year ago in Winter 2023.

| $ billion | Estimate for 2024 in FY2024 Budget | Estimate for 2024 in FY2025 Budget | Change |

| Federal Outlays | $6,371.8 | $6,940.9 | +$569.1 |

| Federal Receipts | $4,802.5 | $5,081.6 | +$279.1 |

| Federal Deficit | $1,569.4 | $1,859.4 | +$290.0 |

You can see line item changes from budget to budget here. You can compare budget estimates with actuals here.

Account level spending estimates through FY 2029 come from the Outlays table in the Public Budget Database and were updated on usgovernmentspending.com on March 11, 2024.

Account level budget authority estimates through FY 2029 come from the Budget Authority table in the Public Budget Database and were updated on usgovernmentspending.com on March 11, 2024.

On March 11, 2024, usgovernmentspending.com updated its data for agency debt from the Federal Reserve Board database. Data is now available for the period 1945-2023. You can see our Agency Debt pag ...

On January 19, 2024 usgovernmentspending.com updated its GDP series with the latest data from the Bureau of Economic Analysis, ...

> blog

usgovernmentrevenue.com

presented by Christopher Chantrill